Growing the Kiva Family: Individual Trustee Spotlight on Davis Mkoji

November 19, 2013

According to UN Habitat, of the four million people who live in Nairobi, over 60% live in slums, 78% of which do not have running water in their homes. Many struggle to pay their rent of $10-35 per month and rarely have enough food to eat. Their children are very lucky if they are consistently able to attend school. For those in better conditions, this reality becomes all the more confronting when these people are your friends and relatives.

So, when Davis Mkoji got a call in early 2012 inviting him to test out the newly-created Kiva Zip program, he jumped at the opportunity. He was already supporting young men struggling to earn a living and knew he would not be able to sustainably meet their needs. Micro-finance institutions were rejecting them and there was no way he could afford to supply the capital himself.

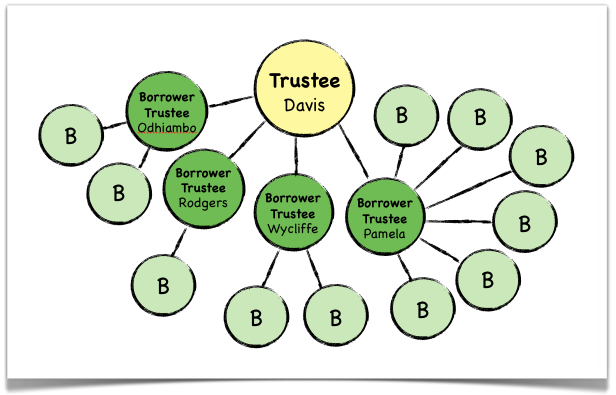

A full-time employee of Kenya Medical Research Institute and part-time lecturer for a private university in communications and leadership, Mr. Mkoji is well-connected and respected in the community, and thus, an ideal individual trustee for Kiva Zip. In the last 17 months, he has endorsed 33 loans for 15 borrowers, four of whom became trustees themselves as part of a “borrower-trustee” experiment launched earlier this year. Now, each of those four borrowers have endorsed one to six others, illustrating the ripple effect that even just one individual trustee can have. Without opening his wallet, Mkoji has granted over a dozen people access to a combined total of $8,400 in loans with a 98% repayment rate.

What is also intriguing about his story is that two of his borrowers are his own brothers, Rodgers and Jimmy. While this may at first seem risky or illegitimate to the outside observer, it has proved very successful for the Mkoji family.

In reference to his endorsement of Rodgers, now a borrower-trustee, Mkoji says “it works because we have a close relationship. He knows [his loan] is linked to my reputation and so he has been supportive and honored the opportunity.” Since beginning a more professional relationship, the brothers have become closer and communicate more often, now connected not only by blood but by Kiva, too.

Rodgers Mkoji (right) with his borrower Samuel (left)

Rodgers Mkoji (right) with his borrower Samuel (left)

When asked how he sees the Zip model going viral, Mkoji believes it will take a combination of more support for individual trustees, who may not have the time and resources to mentor so many borrowers, and the continuation of the borrower-trustee model.

“The impact is humongous and goes beyond my borrowers, some of whom right now are even doing much better than me. [For example] Wycliffe [one of my endorsements] has employed two old guys and become a borrower-trustee.”

The slums of Nairobi are not going to transform overnight, but as more of their residents join the Kiva Zip family, the predicament of poverty seems a little less insurmountable as empowerment and hope are paid forward, one individual at a time.

The Balloon Effect of an Individual Trustee

The Balloon Effect of an Individual Trustee

PREVIOUS ARTICLE

Filming for Kiva, Philippines TAKE SEVEN →NEXT ARTICLE

Kenyan Thanksgiving: A Glimpse Into The Impact of Your Loans →