Home • Microfinance • Article

Introducing the Newest Student-Borrowers in South Africa!

April 29, 2013

These students are in their second year of college at the Maharishi Institute in Johannesburg, South Africa. They will graduate with a Bachelor's in Business Administration in 2015.

As you can see, they had fun taking pictures for their Kiva profiles!

The ladies took the task very seriously. They dressed to impress and made last minute touch-ups to their hair and make-up. And then there was the posing…it was a Kiva photo shoot!

But let me back up and explain how these particular students became Kiva borrowers.

1. All of the students in this cohort were invited to attend a meeting explaining Kiva and the loans offered to them.

The one year loan provides R14,000 (~ $1,550) towards tuition and R425 (~ $50) per month towards living expenses, which most students use for transportation to school.

Students ask questions and review the Kiva brochure, which provides details about the loans

Students ask questions and review the Kiva brochure, which provides details about the loans2. Students interested in Kiva loans fill out applications, including questions about how the Kiva loan would benefit them.

Filling out applications

Filling out applications3. A staff meeting is held to select which students will receive loans.

Gift (Work Study Coordinator), Peter (Academic Coordinator), Max (Bursar), Claire (Communications Officer), and Eric (Student Affairs Coordinator)

Gift (Work Study Coordinator), Peter (Academic Coordinator), Max (Bursar), Claire (Communications Officer), and Eric (Student Affairs Coordinator)Students are evaluated on academic standing, work study record, financial stability, family circumstances, attitude, and attendence.

Gift provides insight into a student's work study performance, Peter evaluates their academic performance and attendance, and Max asseses their financial stability.

If all three give their approval, the student is accepted for a Kiva loan. If there are any concerns, the student is interviewed by Eric to get a better sense of their circumstances.

The Kiva selection committee: Gift, Peter, and Max

The Kiva selection committee: Gift, Peter, and Max5. Selected students attend another meeting to take a Kiva quiz, sign their contracts, and take profile pictures.

Kiva quiz time! Nothing too challening, we just want to make sure they understand the loans.

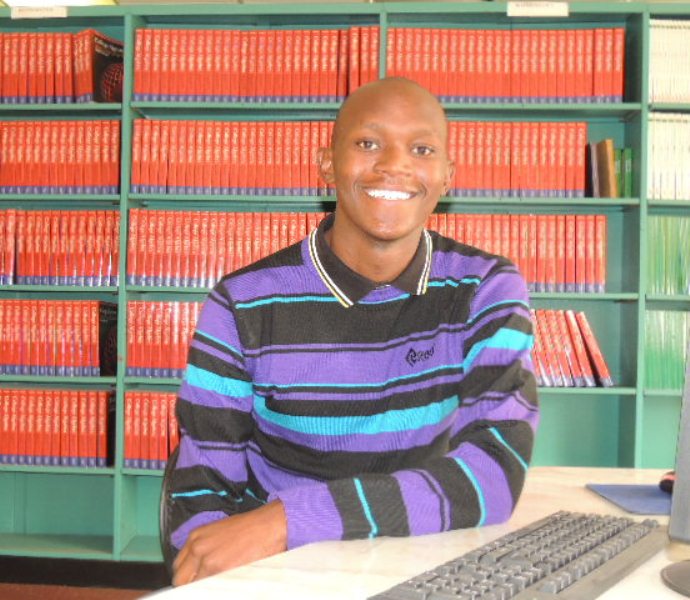

Kiva quiz time! Nothing too challening, we just want to make sure they understand the loans. Picture time! We take pictures in different spaces throughout the school. Gontse is in the library.

Picture time! We take pictures in different spaces throughout the school. Gontse is in the library. 6. Max and I upload the loans to the Kiva website. The great thing about working with college students? They can write their own profiles! We ask them a series of questions and use their written responses for profiles.

For example, when Gontse was asked how the Kiva loan would change his life, he said:

“The Kiva loan will help me and change my life, so that I will focus more on my academics and never stress a lot about my fees. The stipend will help me a lot in the way of transport to school, as I'm using a train to come to school every day, and my other small needs as a student at MI.”

You can lend to Gontse here.

Thabang in front of the school's awesome Mandela clock.

Thabang in front of the school's awesome Mandela clock.When Thabang was asked what he's studying and which classes he prefers, he said:

“I am doing a bachelor Degree in Business (BBA). The classes that I enjoy the most are Business Management and Leadership because I love or like to lead and manage people and things around me.”

7. You--the lender--select a student and lend!

Lend to Thabang here.

Or Bokang, Lwazi, Siboniso, Tshepo, Kagiso, or Vusi.

And Jacob here.

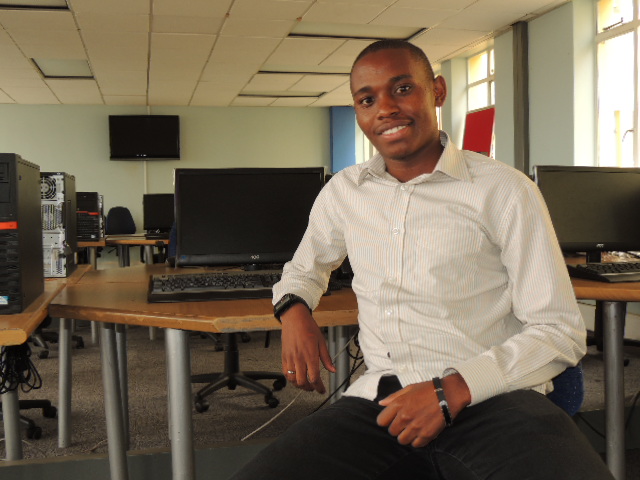

Jacob in the school computer lab.

Jacob in the school computer lab.When asked about his goals after graduation, Jacob said:

“After graduation, I would love to work as a financial analyst and work at the Johannesburg Stock Exchange. A couple of years thereafter, I would like to open my own consulting company. I would love to work in London, UK, but my heart will always remain in Africa, where I’d also open offices around the continent in order to play in the development of Africa’s wealth.”

There are more student loans funding now! Please find them here and select "Higher Education" under Attributes.

And in case you're wondering why I've only linked to the fellas, it's because the girls fund faster. Give some love to the guys, too!

PREVIOUS ARTICLE

Week in Review: Our littlest lenders take over the Kiva office! →NEXT ARTICLE

Kiva Zip hits $1 million! →