We've been hard at work on an update to Kiva's innovative five-star risk rating system!

Last year, we mentioned that we've been working on migrating to a new and enhanced risk model that draws on 38 variables in ten separate categories of information to calculate risk ratings for each of our partners. Just recently, we completed the field work and assessments necessary to successfully re-rate each of our active field partners.

In short, we've now visited each and every single field partner active on the Kiva platform — with the exception of partners in countries that pose a security risk, or in one case a partner that's pending a borrower verification — so that we could gather the information we needed.

As a result, today we can officially announce that we're fully migrating these remaining risk ratings to our new and enhanced risk rating system!

What does this mean for you?

HALF STARS

As a result of this work, our risk rating system now enables us to support half-stars! In other words: historically, a partner could have one, two, three, four or five stars. But now, partners can have half-stars in between those star ratings as well. This half-star support allows us to rate partners with 1, 1.5, 2, 2.5, 3, 3.5, 4, 4.5 and 5 stars.

As a result, we are now able to publish risk ratings with a higher degree of granularity.

Chart shows all active partners with a risk rating (paused partners are excluded)

This has resulted in a number of small rating shifts, such that some ratings may appear to have shifted up or down by half a star. In these cases, we've changed the risk rating on the appropriate partner page. We will also be posting a written explanation on the partner page as well.

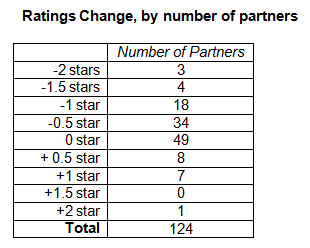

A number of other risk ratings have shifted by more than half a star, as a result of the monitoring visits and field work we mentioned above. How many? To help give a sense of the relative magnitude of changes to Kiva's risk ratings, we've pulled together the following chart showing the number of partners who have experienced a ratings change:

Ratings Change, by number of partners

Table shows shows all active partners with a risk rating (paused partners are excluded)

As you can see, approximately 75% of our partners (96 out of 129 partners) experienced either no change in their risk rating, or only shifted 1/2 a star in either direction (as a result of our enhanced half-star system). The remaining 25% experienced more significant changes, as a result of the updated operational and financial information, as well as other information we have gathered about the institution through conversations with key members of the field partners' staff.

For each and every active partner that experienced a ratings change of any half-star magnitude, we've updated their risk rating and will be posting an update to their partner page.

RISK AND DUE DILIGENCE PAGE

As part of this effort, we've also worked to prepare an overhaul of our Risk and Due Diligence pages in general. We've reviewed the text in our entire risk and due diligence section, and those pages have been updated to include more detail about how Kiva currently works and about the risks of lending through the site.

Full Due Diligence

In the risk and due diligence center, we've fleshed out the description of our current due diligence process, which we're now calling the "Full Due Diligence process". As part of this Full Due Diligence process, we require an on-site visit (with the exception of partners in countries with a security risk).

All but one of our existing field partners to date have been through this Full Due Diligence process (the sole exception is scheduled to first go through a borrower verification process, if they hit loan posting volume as noted here). As part of this process, we have gathered up 38 variables of information and put it into a detailed Risk Model we've developed. This risk model is specific to the microfinance industry. The result is a Risk Rating which gives the risk of institutional default.

We've also updated the Risk and Due Diligence pages to reflect a potential future change: some of the field partners that go through our Full Due Diligence process in the future may not be microfinance institutions, and we may not have a risk model prepared for that field partner's industry.

An example of this might be a farm assistance program. Kiva does not have a formal risk model prepared for that industry. In this case, Kiva would not publish a formal risk rating, and the partner's risk rating would show up as Not Rated. However, Kiva would label loans from that partner as having gone through the Full Due Diligence process, and manually set a credit limit that it considers appropriate to the level of institutional default risk posed by that organization.

Basic Due Diligence

In the new risk and due diligence center, we also describe a new due diligence process that we're calling, "basic due diligence". For these partners, Kiva will perform a basic amount of due diligence, but will not require an on-site visit.

Having a basic due diligence process available may enable Kiva to partner with smaller, innovative organizations that are looking to access smaller amounts of capital. We believe that the basic due diligence process will enable us to more easily partner with smaller organizations doing innovative work that wouldn't otherwise be able to be featured on the Kiva website.

For partners undergoing basic due diligence, we won't be doing on-site due diligence and the level of desktop due diligence will also be less intense. As a result, we will not be providing a risk rating for partners who have undergone basic due diligence. They will show up as "non-rated" partners, and will have a lower level of fundraising limits than even a one-star partner that has been through our Full Due Diligence Process.

Risk Statistics

One last note: we firmly believe that half-stars will offer a higher level of granularity around risk ratings. That said, we have previously been able to offer risk statistics filtered by each of our five different star risk ratings. Calculating these statistics, however, has been becoming increasingly challenging. For technical reasons, as the number of loans made through Kiva increases, it has taken our servers longer and longer each day just to calculate the risk statistics. Adding four additional half-star risk ratings will make the calculations even harder to pull off.

But most of all, we’ve noticed that very few lenders visit the risk statistics page at all (~500 people this year, actually). Given these technical challenges and limited lender interest, we're going to focus our risk stats page on the overall risk statistics. You can see the results here, starting tomorrow:

http://www.kiva.org/about/risk/stats

Conclusion

In conclusion, our new and enhanced risk rating system has several advantages:

- More granularity: The new and enhanced risk rating system reflects a higher level of granularity for risk ratings, as we shift from a five level system to a rating system with nine levels, all within the five-star framework.

- More due diligence and more data: The new and enhanced risk rating system also reflects an increased level of on-site due diligence for many of our field partners, allowing us to update our risk ratings to reflect more operational and financial information we've gathered about each institution, and through conversations with key members of the field partners' staff.

- Smaller innovative partnerships: Finally, as a result of our new Basic Due Diligence level, we are now able to partner with smaller, innovative organizations that are looking to access small amounts of capital.

We're very excited about our shift to this new and enhanced risk model. If you have any questions, please don't hesitate to contact us at contactus@kiva.org!

PREVIOUS ARTICLE

Observing Kiva’s Raison d’Etre in my First Field Visit →NEXT ARTICLE

Beginning of a Tajikistan Journey →